OK Goodbye, Hello Auto-Reconcile

If you haven’t noticed, Xero has now given you the opportunity to Auto-Reconcile using AI. It is a development we have been awaiting for some time. In fact we have been wondering why it was taking so long, so obvious was the feature. Having used it for a month we are ready to give our review.

It’s very good

The big question with the feature was how much time it would save. Clicking the OK button on Xero is hardly time consuming as it is. Rectifying bookkeeping mistakes on the other hand can be extremely laborious. So the first thing we wanted to know was whether it would make a lot of mistakes and whether they would be hard to spot.

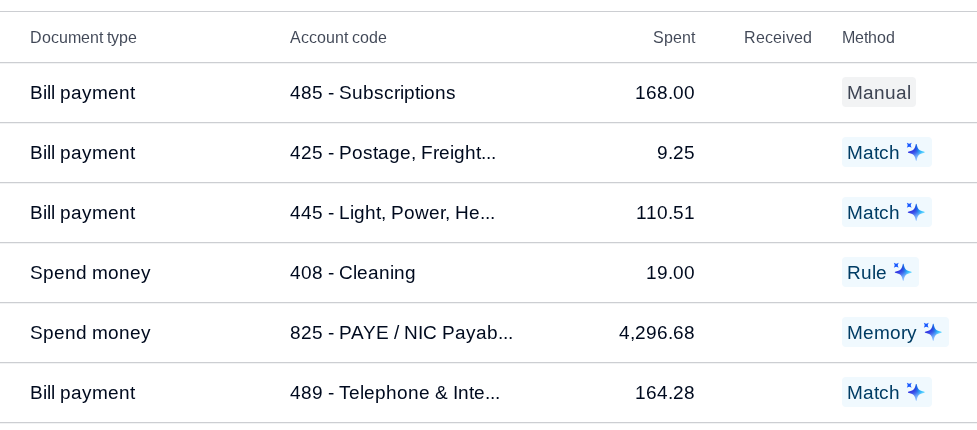

The feature auto-reconciles on the basis of four ‘thought processes’:

Match - the bank transaction matches a bill or invoice

Rule - it is applying a pre-existing rule that someone has set up

Memory - it can see that similar transactions usually get reconciled in the same way

Prediction - it thinks it can see a pattern with other transactions

One very good feature of the functionality is that it allows you to review its work easily at the click of a button.

To date we have yet to spot anything that has gone awry.

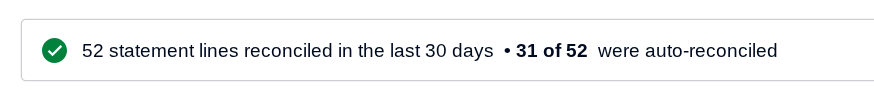

It is also dealing with most transactions:

Is this the end of bookkeepers?

It’s a valid question but the answer in our opinion is: no, but the job is less and less what it used to be and may end up a very different skill set. We have to remember that the part of the job that was clicking ‘Ok’ which Auto-Reconcile is now doing was already not what takes the time in bookkeeping. The part that takes the time are the 11 of the 52 Auto-Reconcile couldn’t deal with because a question needed to be answered. Questions like:

Which bills did this one payment pay for?

What was the VAT on this purchase?

Why does this payment received not match the invoice I can see to the same customer?

What was bought in this Amazon purchase?

That is not to say that AI will not develop to be able to start dealing with some of these questions also, but we believe there will always be issues that will require human intervention.

Then there is the fact that Auto-Reconcile addresses only one of the three bookkeeping inputs which are Sales Records, Purchase Records and Bank Transactions. In many cases bookkeepers' time is spent working on Sales and Purchase Records.

And finally it is important to understand that the machine needs to learn from us. All four of the ways that Auto-Reconcile does its job: Match, Rule, Memory and Prediction are built on the work of a bookkeeper. What is clear however is that the role of bookkeeper is changing. Xero and Dext are highly sophisticated tools that require technical knowledge to get them running well. The bookkeeper’s job now revolves around setting up the machines and making sure they are running smoothly.

Should I use it?

There is one big question unanswered with Xero’s AI: What will it cost?

Our impression is that all accounting’s big tech companies have raised huge amounts of money from investors. Those investors understandably want a return. At present Xero’s AI is free but we already know they plan for it to become a paid for add-on. Ultimately the question of whether the functionality is useful will come down to the price tag they place on it.

There are some other questions too. AI is notorious for its energy consumption. How will AI affect Xero’s sustainability objectives: https://www.xero.com/uk/sustainability/environment/?

Whilst we don’t have the answers to these questions, we are going to stand by our principle of embracing technology and getting it to work for us. We have long wondered why we had to click ‘Ok’ to some transactions on Xero it was so obvious it was Ok to reconcile them.

Small businesses need plenty of help, if this allows us to keep bookkeeping costs down and provide better service in other ways, we want to be front of the queue.